Cake DeFi's Services Simply Explained

Cake DeFi focuses on providing a simple user experience and generating high returns for users. Our vision is to eventually become a true one-stop platform that manages all your financial assets. We are constantly adding new features and enhancing our platform.

The purpose of this article is to help you get to know our products and to show you how you can benefit from them easily.

1. Buy Bitcoin, Ethereum or DeFiChain directly with Euro / Dollar

5. Invest in Decentralized Assets

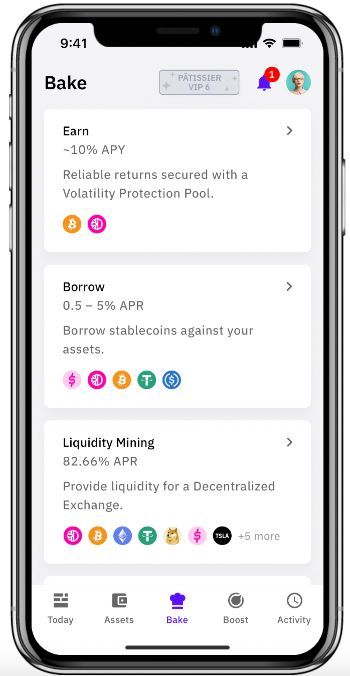

6. Earn Service

1. Buy Bitcoin, Ethereum or DeFiChain directly with Euro / Dollar

Cake DeFi now offers BTC, ETH and DFI purchases. Our trusted partners BANXA and Transak handle all purchases for Cake DeFi, and when you use their services to make a purchase, the cryptocurrencies are automatically credited to your account.

This makes it easy for you to buy Bitcoin, Ethereum, or DeFiChain with SEPA or credit card. Follow these simple steps:

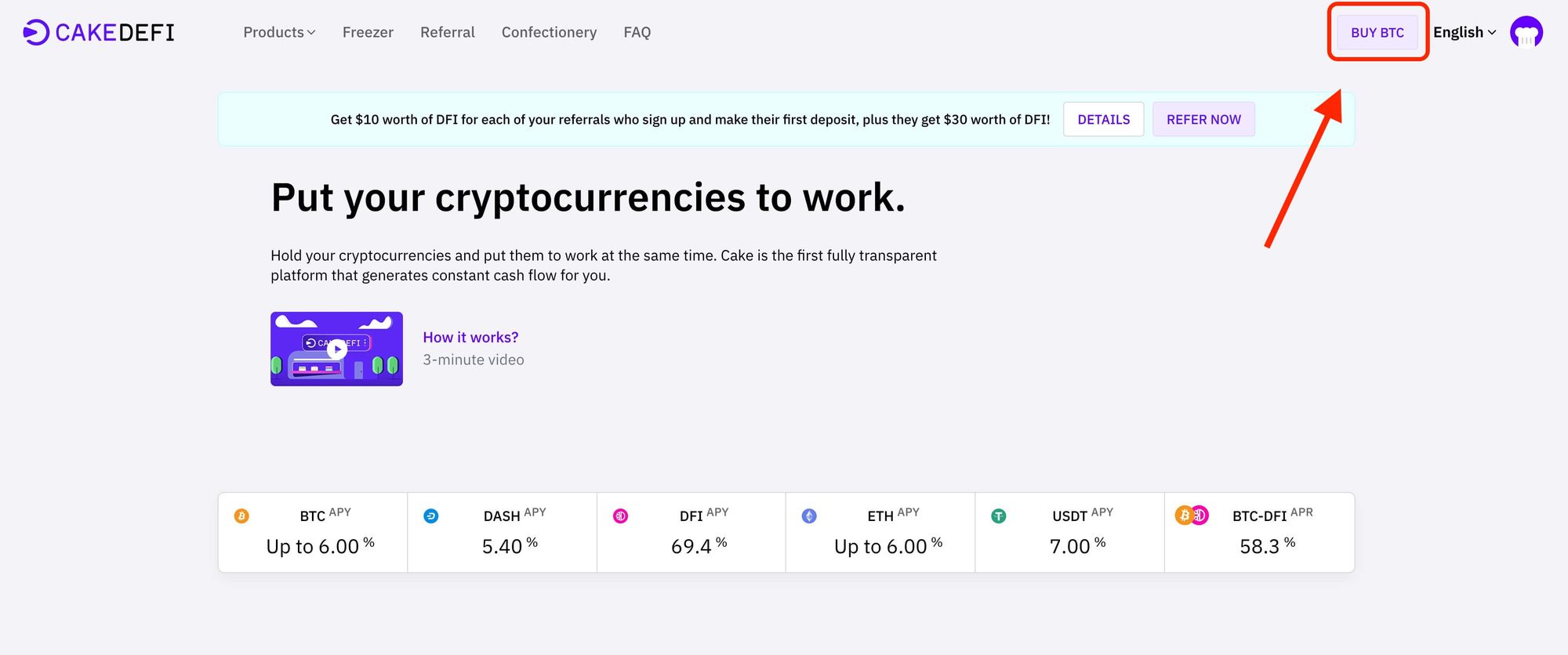

1) Log in to Cake DeFi

2) Click on "Buy BTC" in the menu at the top

After you click on the "Buy" button, you will be able to choose your preferred coin, partner and payment method (with all conditions and fees disclosed of course).

The entire process has been clearly outlined for you, with step-by-step instructions to guide you. Your BTC/ETH/DFI will be automatically deposited into your Cake DeFi account after the purchase.

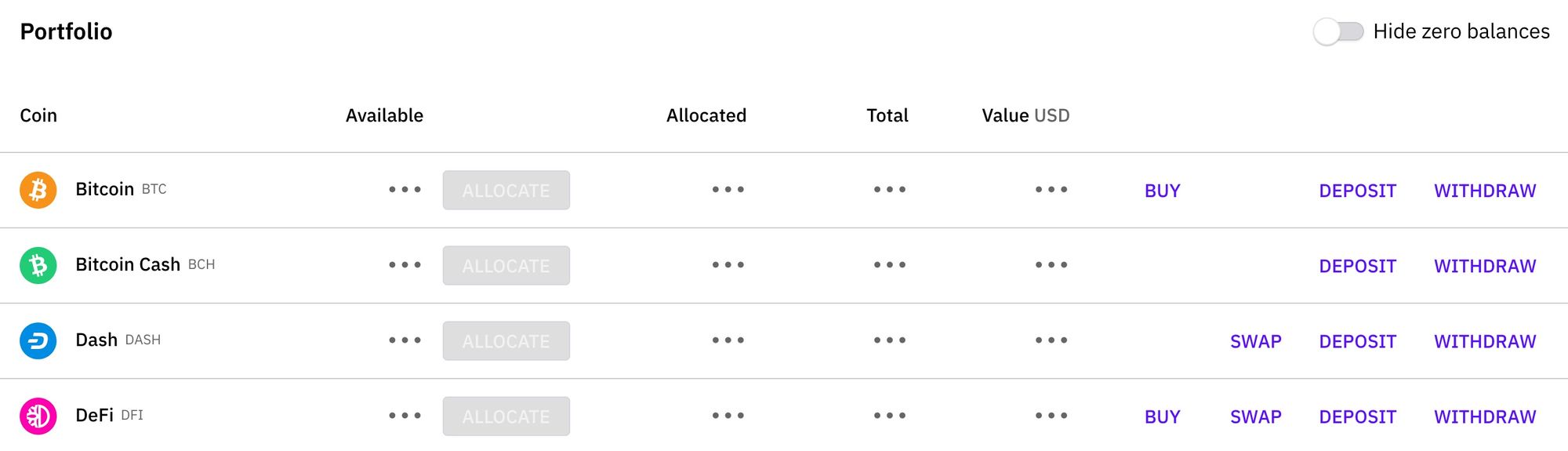

You can find your cryptocurrencies on your balances page:

After you have some cryptocurrency, like BTC, ETH, or DFI in your account, you can use other Cake DeFi products to generate high returns and rewards.

In-depth information:

- Is there a minimum and a maximum to buy cryptocurrencies with fiat?

- Through which partner is the purchase of cryptocurrencies with fiat completed?

2. Lending Service

Lending allows you to earn a passive income (cash flow) on your bitcoin, ether, USD Tether as well as USD Coin. Your returns are fully guaranteed and risk-free, with possible bonuses on top (bonuses = additional returns on top of the guaranteed returns).

- Every Friday we offer BTC / ETH / USDT / USDC Lending batches that runs for 28 days.

- The base return of BTC / ETH / USDT / USDC Lending is guaranteed (see below). There may be potential bonus returns if the spot price of BTC / ETH gets within a certain price range.

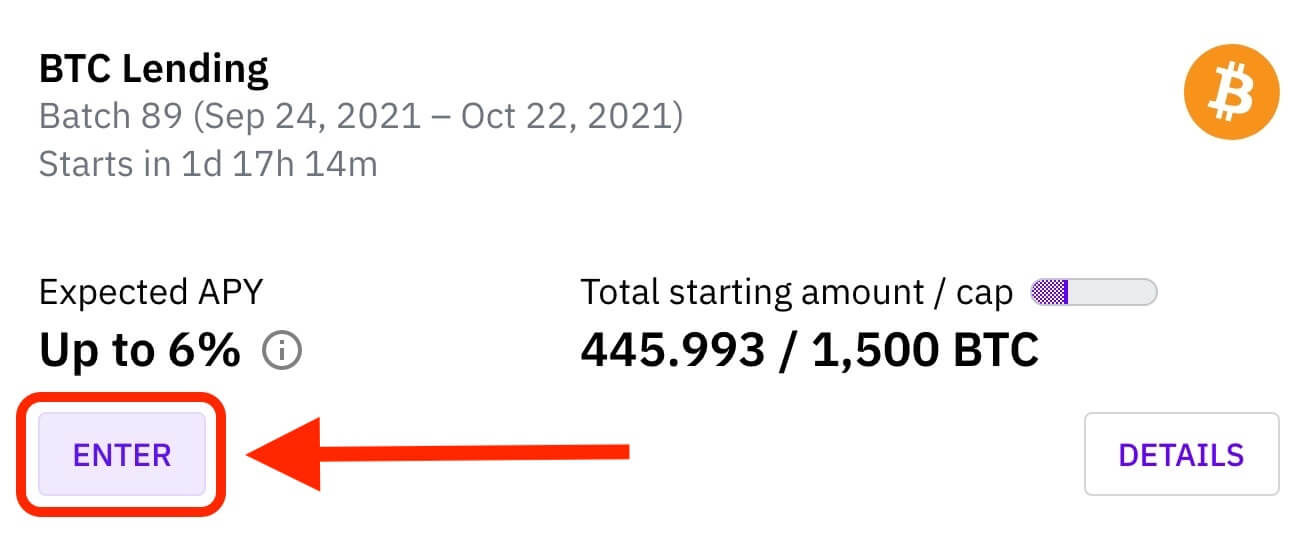

- The expected APY (annual percentage yield) may vary from batch to batch. We display the expected APY on the website before you join a batch.

- You can participate with any BTC / ETH / USDT / USDC amount of your choice.

- Once you choose to participate, your BTC / ETH / USDT / USDC will be locked into option contracts for the next 4 weeks.

- After the 4-week period of the batch, you will have the option to automatically enter the next batch (to generate automatic compound interest), withdraw only your return, or withdraw your entire principal and your return back into your account.

Here's a simple sequence on how you can enter into a batch:

- Go to https://app.cakedefi.com/lending

- Scroll down until you see your desired batch (BTC / ETH / USDT / USDC)

- Click on "Enter"

- Next, just enter your desired amount that you would like to invest and you are all set.

Every four weeks, you'll receive guaranteed returns credited directly to your account. By default, your contribution and returns are automatically added to the next batch. Consequently, you don't need to do anything but sit back, reap the benefits of compound interest, and enjoy your cake while your bitcoins do their job.

Besides Bitcoin, Ethereum, USDT, and USDC lending, we also offer Staking services.

In-depth information:

- What are the expected returns of the USDT Lending service?

- With which coins can I use the Lending service?

3. Staking Service

There are various types of consensus mechanisms. The two most common and well-known ways to reach consensus on a decentralised blockchain network are Proof-of-Work (PoW) and Proof-of-Stake (PoS). The Proof-of-Stake consensus mechanism involves putting coins or tokens into so-called "nodes" to verify transactions for cryptocurrencies. As a reward for providing this service, stakers receive staking rewards. Depending on the coin, the rewards may vary.

Cake DeFi currently supports the following coins for Staking:

- Dash (DASH)

- DeFiChain (DFI)

- Ethereum (ETH)

There are two different ways to participate in Staking:

- Transfer your desired Staking coin directly into your Cake DeFi account

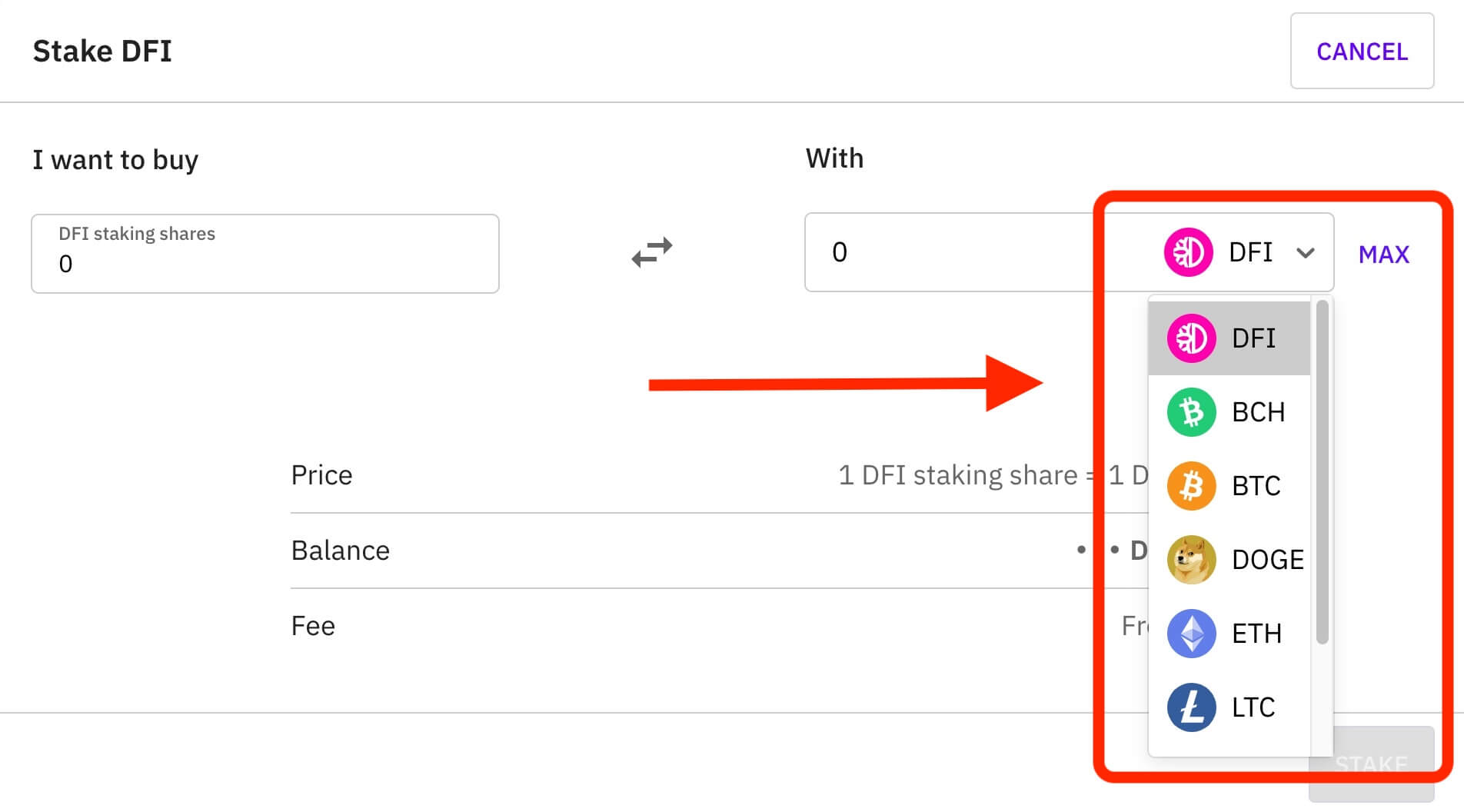

- Exchange your freshly purchased BTC/ETH/DFI with your desired coin. In order to do this,

- Click on "Products" in the upper left corner and choose "Staking"

- Click at your desired coin on “STAKE”

- Select any coin available to buy your staking shares with

How to send your staking coin directly to Cake DeFi

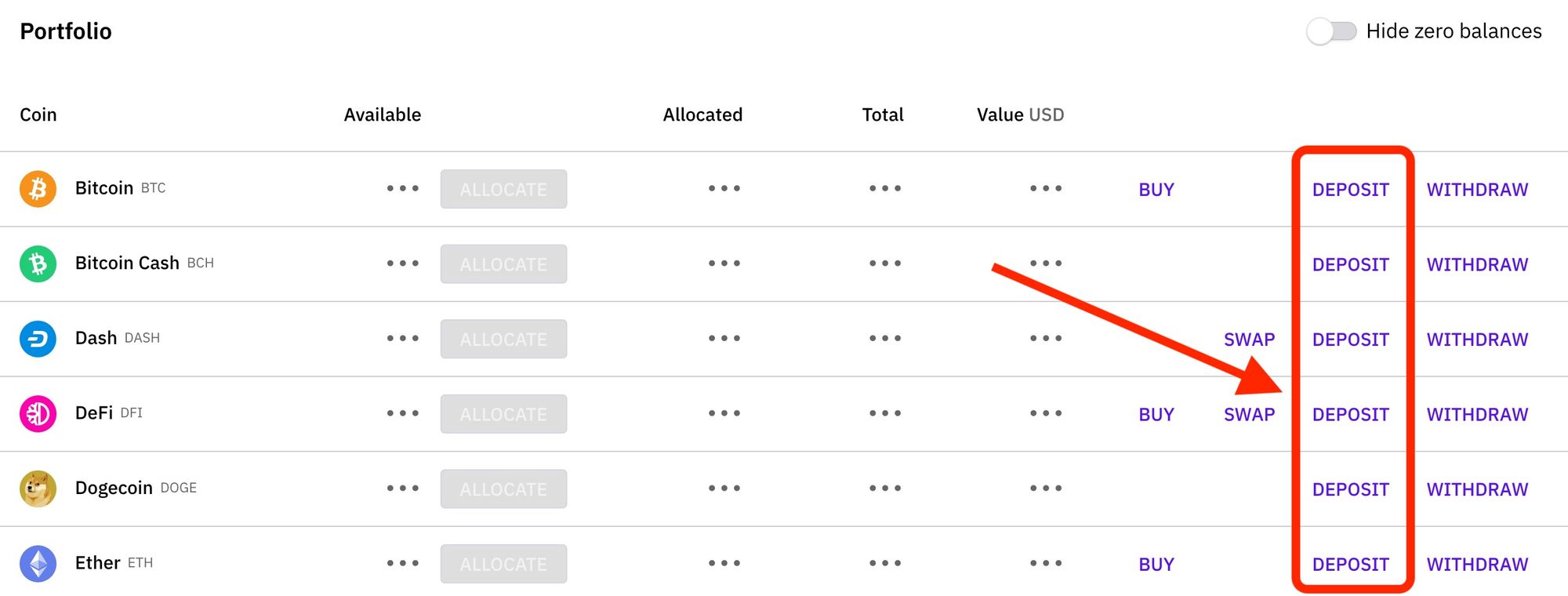

- Click on "Balances" in the upper right corner of your profile.

- Click on "DEPOSIT“ right next to your desired coin

3. You can now send your coins to this address. (Important: Send ONLY the selected coin to this address, no other coin!)

It is important to note that there is no minimum term with Staking. Staking can be done at any time, and you can even remove your coins when you wish. Depending on the coin, you will receive your rewards twice a day. The default setting for Staking is the same as that for Lending.

In-depth information:

- Can I run a masternode myself? Why should I use Cake DeFi?

- What is the smallest amount of staking shares that I can purchase?

4. Liquidity Mining

With Liquidity Mining, you provide liquidity for users who want to do a swap of cryptocurrencies on the decentralized exchange. In contrast to other products, liquidity mining is a more complex product that cannot be properly explained in a few sentences. Here's a more comprehensive, yet still simple explanation: Liquidity Mining simply explained

Participate in Liquidity Mining in just a few steps:

1) Log in at https://app.cakedefi.com/

2) Click on "Liquidity Mining" under "All Products" in the top menu or follow this link

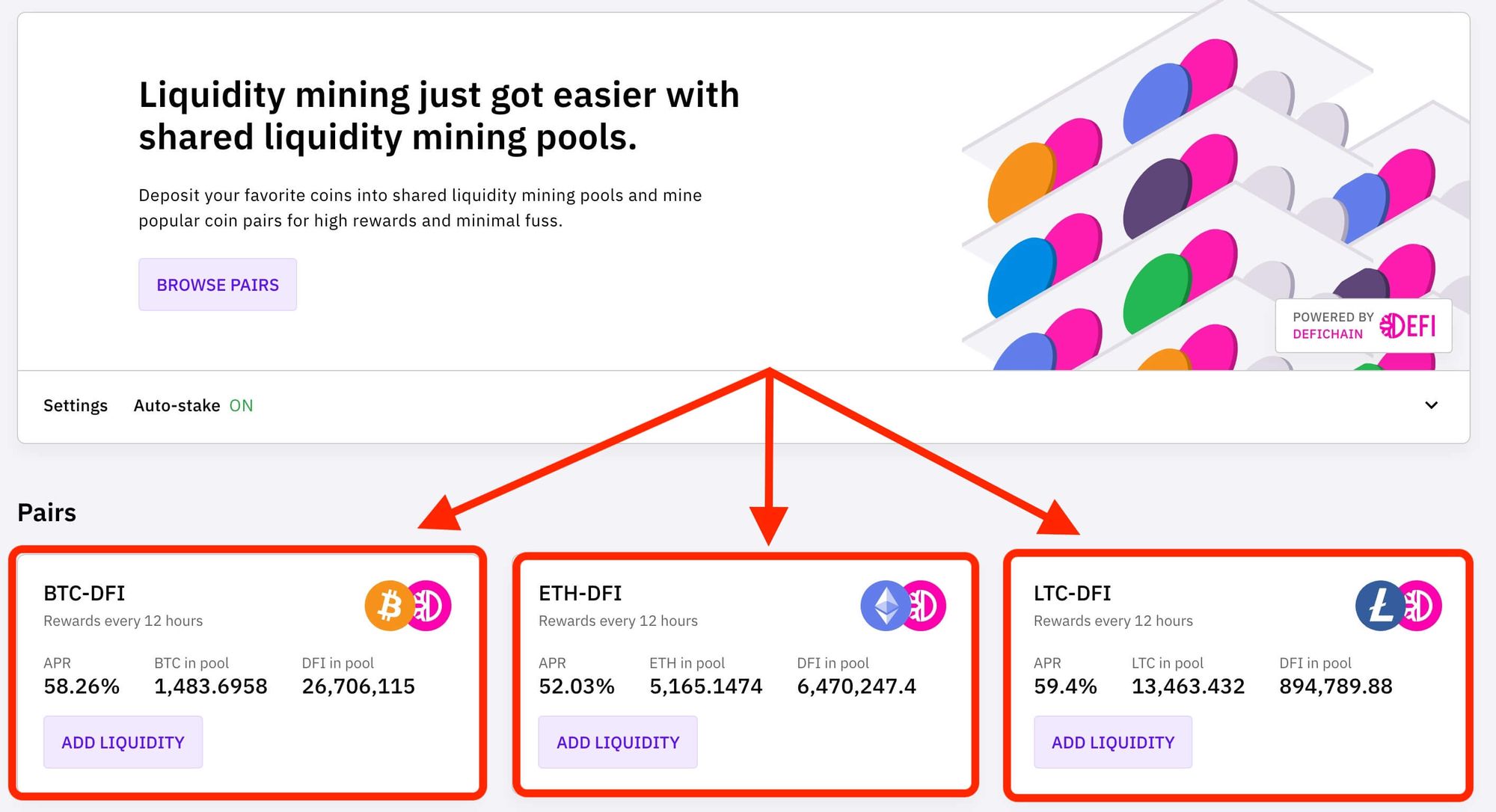

3) Now you have the different liquidity pools available to participate in Liquidity Mining:

BTC - DFI

ETH - DFI

USDT - DFI

USDC - DFI

LTC - DFI

BCH - DFI

DOGE - DFI

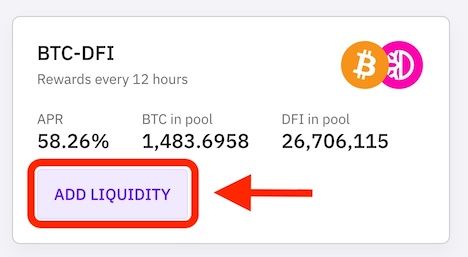

4) After you have chosen a liquidity pool, you can simply click on "ADD LIQUIDITY".

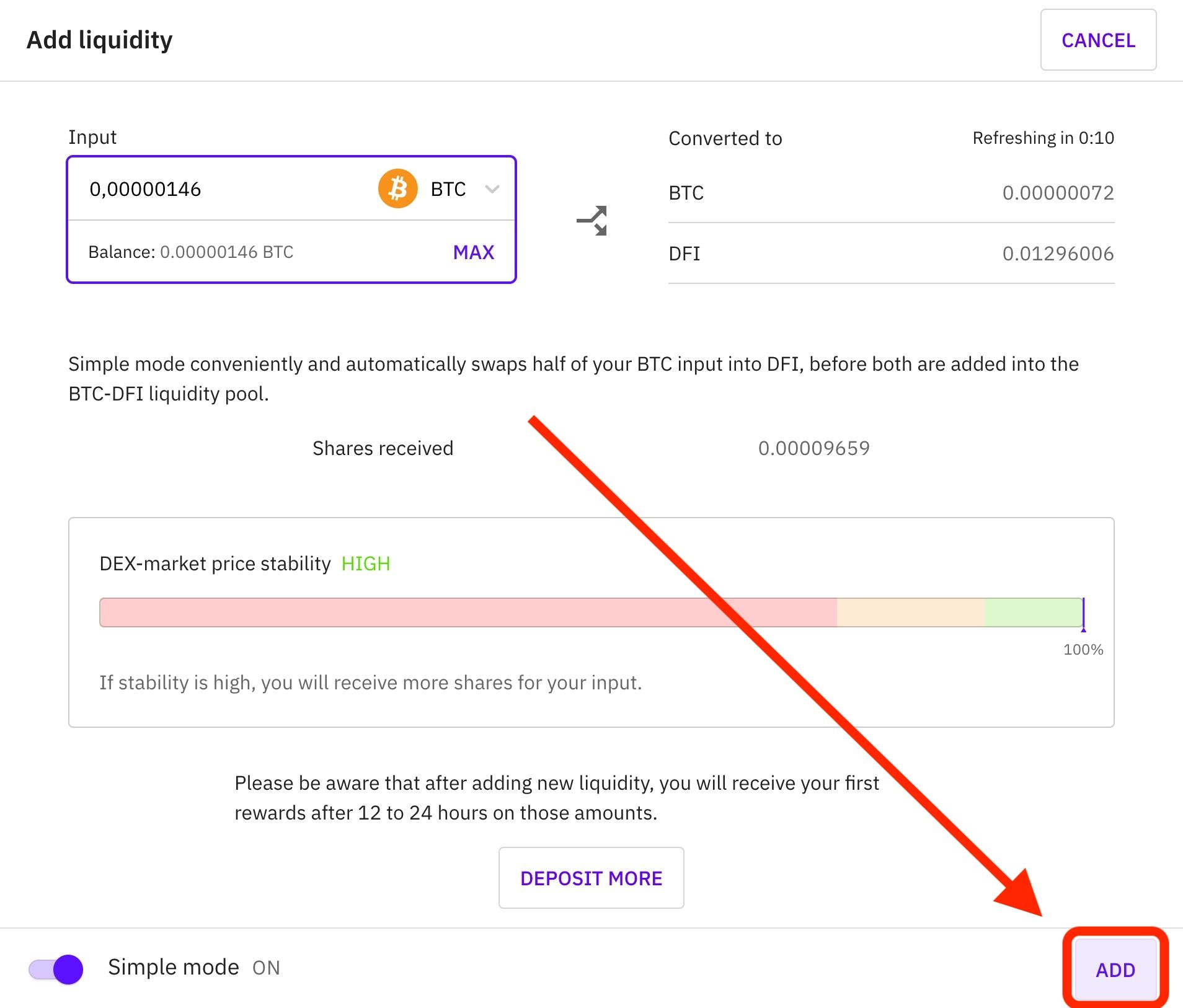

5) Now you can enter your desired amount. For the other coin pair, the amount is automatically calculated so that they are in proportion.

Once you have chosen your amount, you can click on the button: "Add".

A security warning pops up. Please read it carefully and do not click on the confirmation until you have fully understood it.

For the 7 Most Frequently Asked Questions about Liquidity Mining click here.

For more information about the risks involved with Liquidity Mining click here.

For the expected returns on Liquidity Mining click here.

NEW: Liquidity Mining with dToken!

5. Invest in Decentralized Assets

There are two main things you can do with Decentralized Assets such as dTSLA on Cake DeFi

- You can get price exposure by simply buying and holding decentralized assets

- You can participate in Liquidity Mining with Decentralized Assets once you have purchased the dToken pair you wish to use

What exactly are Decentralized Assets on Cake DeFi?

Decentralized Assets on Cake DeFi such as dTSLA are in fact nothing else than cryptocurrencies and can be minted (created) by anyone on the DeFiChain blockchain.

The price of dTokens like dTSLA is determined by supply and demand and can be traded on a decentralized exchange (DEX). What makes them interesting, though, is that the price may not necessarily be correlated to the rest of the crypto ecosystem, but rather to real world assets.

If, for example, you invest in dTSLA, then you are not investing into the real TSLA stock, but you are rather investing into a digital token that is likely to follow the price of TSLA amongst other variables. As such, dTSLA is a decentralized asset, created by anyone and backed by nothing else but cryptocurrencies such as DFI, BTC or stablecoins like USDT or USDC.

Learn more about what decentralized assets are and how you can invest in them for returns upwards of 100% on Cake DeFI here.

6. Earn Service

EARN is a revolutionary DeFi service that allows Cake DeFi users to generate cash flow from their BTC or DFI. It can also be described as a one-sided liquidity mining service that offers more stability and security.

How do you use EARN?

If you're familiar with liquidity mining, great - EARN works the same way, except that users are only required to allocate one type of crypto. So, how does it work? The processes involved are as follows:

- User allocates one type of crypto.

- User’s crypto will be paired with another crypto (depending on the type and amount of crypto allocated) and then invested into a Liquidity Mining pool.

- Rewards will be paid out every 24 hours, minus Cake DeFi’s fees and a fixed percentage of which will be contributed to the volatility protection pool, and are automatically reinvested for the user's convenience. These rewards will be in the same type of cryptocurrency that the user allocates.

To start using EARN, simply download the latest version of the Cake DeFi app by clicking here. Once inside the app, simply select EARN from the list and start allocating BTC or DFI.

To know more about EARN, you may click here to read the article from our blog section.

7. Borrow with Cake DeFi

Crypto investors who do not wish to sell their crypto assets but want to receive funds to support their lifestyle can use Cake DeFi’s “Borrow” service and put their crypto assets as collateral.

What crypto assets can they use as collateral?

Borrowers can pledge DFI as collateral or combine it with Bitcoin (BTC), Ether (ETH), Tether (USDT) and USD Coin (USDC) (as long as 50% of the collateral is DFI). In return, borrowers receive the stablecoin DUSD.

What is the benefit of borrowing DUSD?

Just like any other stablecoin, DUSD can be used to purchase items or, even better, participate in other investment opportunities. In fact, a practical way to invest the DUSD borrowed would be to participate in Cake DeFi’s Lending, Staking and / or Liquidity Mining either directly or by swapping the DUSD into other coins.

What are the risks of using “Borrow”? Does it have certain limitations or restrictions?

Indeed, every investment tool has certain risks, limitations and / or restrictions attached to them. Users of Cake DeFi’s “Borrow” service, for example, should be aware that their collateral will be at risk of being liquidated if it drops below the 200% collateralization ratio.

To avoid this, borrowers should be mindful of the amount of DUSD that they are being allowed to borrow - which can be seen in real-time as they key in the total amount of collateral that they are willing to pledge.

Can borrowers convert the DUSD that they borrowed into other crypto assets?

Indeed, they can convert the borrowed DUSD into USDC or DFI without any conversion fee. However, conversion is no longer allowed once the borrowing process is complete and the DUSD appears on the borrower’s wallet.

It should also be noted that borrowers may only convert DUSD into USDC through the “Borrow” service, and that there are no other features available on the Cake DeFi platform that allows this action to take place.

Finally, this service can only be accessed through the Cake DeFi mobile app and is only available to those with verified accounts.

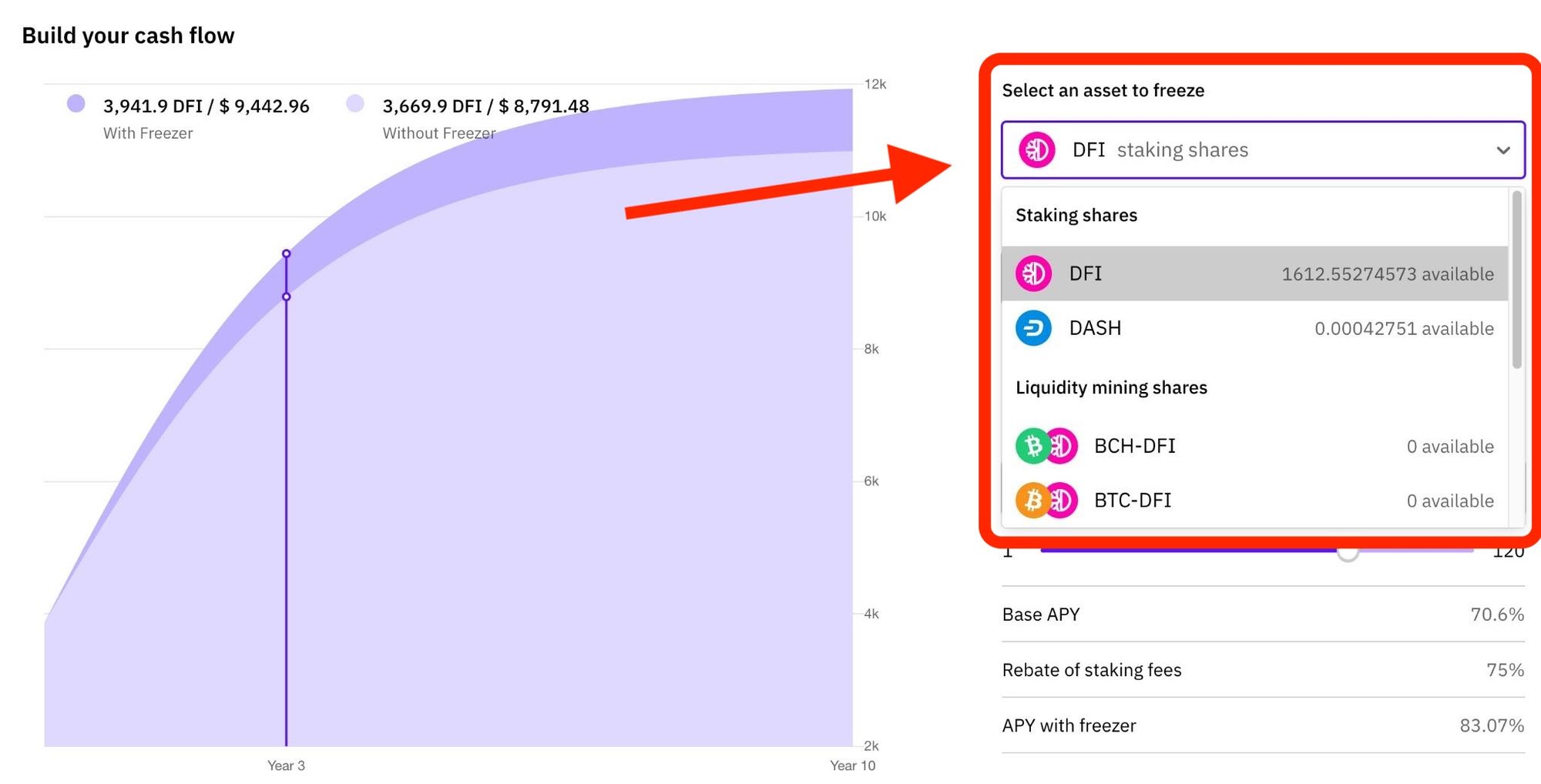

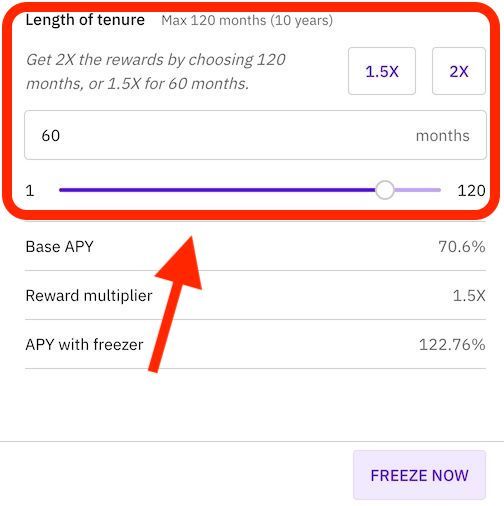

8. Freezer

The Freezer rewards you for committing your funds for a certain period of time, from just one month up to ten years. The service is available for funds allocated to Staking & Liquidity Mining.

You can save up to 85% on Cake DeFi's fees with the freezer. Due to the funds being locked on the DeFiChain blockchain, the 5 year and 10 year DFI Staking freezers differ somewhat. As a result, users can receive up to two times the normal staking rewards.

To learn more about the new on-chain freezer, read here.

How to use the Freezer to receive more rewards?

1) Make sure you already have funds allocated towards Staking or Liquidity Mining

2) Go to https://app.cakedefi.com/freezer

3) Select the asset you want to freeze (Staking/Liquidity Mining shares):

4) Select the length of time you want to freeze your funds:

5) Click on “Freeze now”

For more information about the regular Freezer with 3 different use cases click here.